#48: Strategizing Venture Governance for Corporate Innovation: A Deep Dive with one of WhatAVenture’s Lead Venture Architects - Georg Horn

Hi, I'm Jeppe and welcome to my weekly newsletter on Corporate Venturing, released every week. My aim is to provide a comprehensive perspective on the latest developments in the field and its related topics, drawing from the insights of top management, venture capitalists, founders, LPs, and family offices. I aim to offer valuable information and thought-provoking content that will aid in understanding the importance of Corporate Venturing in business strategy.

Today I have the pleasure of interviewing Georg Horn who is an experienced two-time founder and seasoned business consultant, bridging the gap between startup agility and corporate structure with ease. His diverse founding ventures range from e-commerce to cutting-edge SaaS inclusive machine learning technologies, covering every stage from ideation to market launch, and even exits. Hailing from a quaint Swiss village, Georg's innate curiosity has led him to study, work, and live across Europe and beyond, enriching his global perspective. His profound passion for ventures, innovative business models, and the drive for innovation have seamlessly integrated him into the WhatAVenture - Corporate Venture Builder team, where he plays a crucial role in steering teams and clients towards their ambitious growth objectives.

Defining Venture Governance

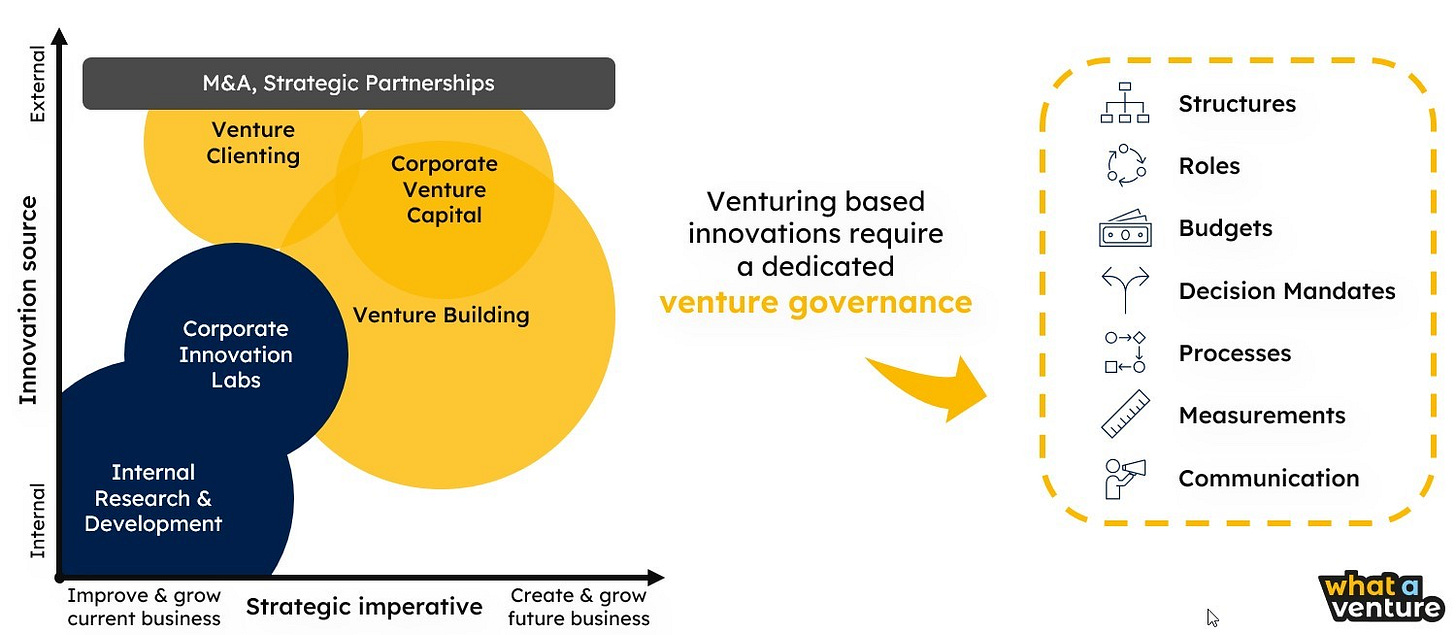

In our enlightening conversation, Georg provided a comprehensive definition of "Venture Governance" within the context of corporate innovation. He described it as an integral component of the broader innovation governance framework, crucial for navigating the complexities of radical innovation. Venture Governance, according to him, is pivotal for corporations that embark on venturing activities, especially in the non-incremental innovation domain, where traditional governance structures may fall short.

Georg also highlighted the multifaceted nature of corporate venturing, comprising venture building, clienting, and corporate venture capital. Each domain demands a tailored governance approach to effectively support and nurture ventures from inception through to scaling. He stressed that while not all corporations need to engage across all three venturing domains, those that do must develop dedicated governance strategies, ensuring a coherent alignment with the overarching corporate innovation and growth strategy. This ensures that ventures are not isolated but rather contribute to and benefit from the corporate innovation agenda, driving strategic growth and diversification where it is intended.

Horn stressed that fundamentally, Venture Governance is an essential element and link in the chain of innovation activities from search field definition and ideation to executing and scaling. If this link falls short, the entire chain of prior activities in the innovation process can be nullified.

WhatAVenture's Approach

Georg elaborated on WhatAVenture's unique stance towards Venture Governance, emphasizing a holistic approach that covers the spectrum of venture building, clienting, and corporate venture capital. He clarified that while WhatAVenture advocates for a comprehensive engagement in corporate venturing, the firm recognizes that not all clients may wish to pursue all three areas simultaneously or to equal extent. Different strategic growth and innovation priorities will lead to different focuses.

Recognizing ventures and acknowledging their different nature

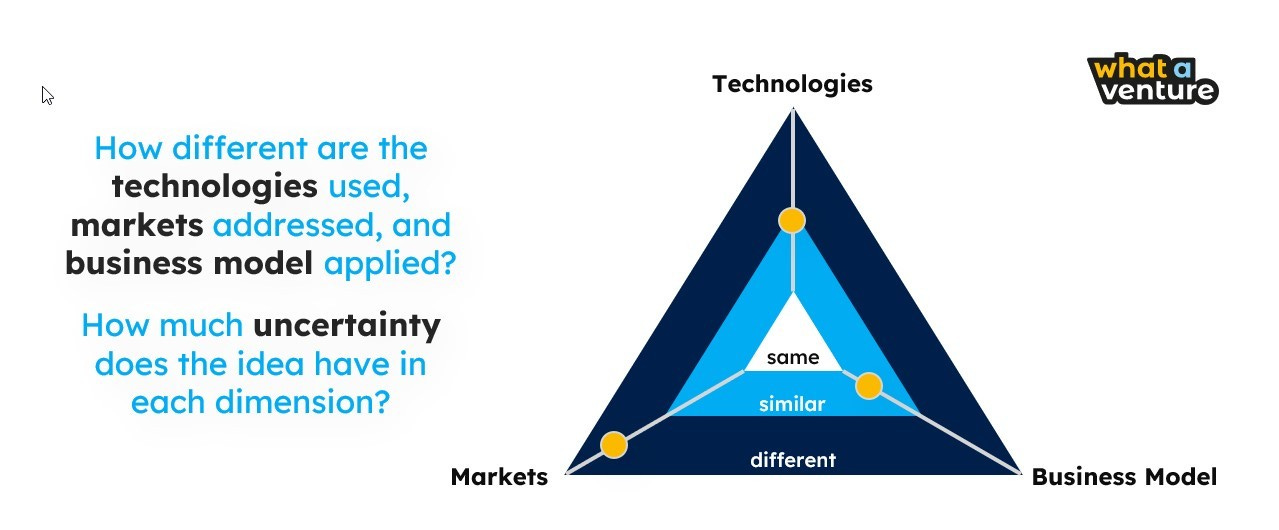

Georg pointed out that a common challenge in Venture Governance is the misidentification of ventures and a lack of appropriate and systematic execution knowledge, leading to ad hoc and inefficient decision-making.

The corporates need to first understand that there are fundamentally different types of innovations. Once this clarity is established, it becomes clear that also a different governance framework will be required to enable each innovation type to thrive. The modus operandi required to successfully execute radical innovations is vastly different compared to what you need to succeed with incremental innovations.

Success Stories

Georg Horn shared an illustrative success story that underscored the significance of WhatAVenture's governance model in the successful launch and scaling of a corporate venture. The project involved a comprehensive Venture Governance framework for an Austrian company in the manufacturing space. This end-to-end governance project encompassed strategic planning, legal structuring, and the establishment of clear decision-making processes and revenue expectations for new ventures. The focus here was on venture building and corporate venture capital – all alongside successfully building a new venture.

Challenges in Venture Governance

According to Georg, the challenges in Venture Governance can come in many shapes and sizes. Often times it’s the seemingly simple processes that highlight the pain points. For example; how can a venture send out an invoice? Sometimes corporate processes only allow for automated invoicing – with pre-defined accounting and banking parameters. What if a simple way to accept first payments as part of my venture validation journey is needed?

Emerging Trends

Horn points out the growing realization among corporations about the breadth and challenges of corporate venturing. This awareness is prompting businesses to seek clarity and strategic guidance on leveraging the different venturing types effectively. As such, the topic of corporate venturing has gained a lot of traction in the past years. Many firms started to engage in different activities – often without the necessary groundwork of Venture Governance. This lack of structure and guidance is now becoming apparent, corporates realize that they too often follow no or only ad-hoc procedures, instead of a systematic approach.

Collaborative Ventures

Collaboration between corporations and startups, a vital component of venture clienting, faces challenges primarily due to the disparity in scale and operational dynamics. Horn stresses the importance of establishing tailored processes to facilitate smooth collaboration while managing corporate risks. He identifies procurement processes as a significant barrier, where startups are often subjected to onerous qualification criteria, leading to potential collaboration failures. By defining dedicated processes that acknowledge the startups' scale and capabilities, WhatAVenture always tries to ensure efficient and risk-mitigated collaborations between the corporate and startup ecosystems. The process of venture clienting starts however much earlier, with targeted scouting and vetting of potential collaboration partners.

Future Outlook

Looking forward, Horn envisions a landscape where Venture Governance gains prominence and recognition as an indispensable facet of corporate venturing. He anticipates a shift from the current scenario, where the need for Venture Governance is advocated, to a future where it's actively demanded by corporations aware of its criticality. Horn asserts that while some aspects of Venture Governance might see automation, the core governance framework as such, will still have to be established and agreed upon by humans. Execution and controlling are where automation will come in. This can be in approval frameworks, or regarding smart contracts.

Conclusion

I want to thank Georg Horn for a very engaging discussion. We gained profound insights into Venture Governance, highlighting its crucial role in aligning innovation with corporate structure. Horn's expertise in navigating the challenges and trends within corporate venturing provided valuable perspectives on effective collaboration and the future of Venture Governance. This conversation is a testament to the evolving nature of corporate innovation, underscoring the importance of aligning innovation strategy with well governed venturing activities, in driving successful growth initiatives.

I hope you enjoyed this week's newsletter. If you have any suggestions or contributions that you would like to share with me, please do not hesitate to reach out. I would be delighted to hear from you.

/Jeppe