Exploration and Innovation: Revisiting Corporate Risk-Taking

Hi, I'm Jeppe and welcome to my weekly newsletter on Corporate Venturing, released every week. My aim is to provide a comprehensive perspective on the latest developments in the field and its related topics, drawing from the insights of top management, venture capitalists, founders, LPs, and family offices. I aim to offer valuable information and thought-provoking content that will aid in understanding the importance of Corporate Venturing in business strategy.

During last week, I had the pleasure of delving into the 395th episode of the Lex Fridman podcast, featuring the insightful Walter Isaacson after release of his latest book on Elon Musk. In the episode Walter reminds us on the captivating journey back in time to the era when Europeans first set foot in America.

The explorers who laid the foundation of venture capital

Let's take a moment to transport ourselves to the late 15th century, where notable explorers like Christopher Columbus in 1492 paved the way for others, including Amerigo Vespucci, John Cabot, and Pedro Álvares Cabral, to venture into various corners of the Americas. Remarkably, this historical epoch serves as a remarkable backdrop to the origins of what we now know as the Limited Partnership.

These daring Captains weren't just fearless explorers; they were also skilled fundraisers, engaging with various companies and high-net-worth individuals. This collaboration between Limited Partners and The Captains established the structural groundwork for the contemporary world of Venture Capital as we recognize it today.

However, one can't help but ponder the fate of corporate risk-taking, the very essence that once fueled exploration, wealth, and innovation. As Walter Isaacson astutely observes, it has fallen under heavy regulation and administration. Our society has spawned an array of administrative functions, predominantly geared towards monitoring and overseeing exploration, significantly dampening the spirit of discovery and innovation.

This notion resonates with prior newsletter where Linda Yates in 'The Unicorn Within,' underscores the critical importance of crafting a clear and engaging structure with active C-level involvement. It's imperative to construct a framework that allows for unfettered exploration and innovation, free from the constant interference of the corporate hierarchy.

The "Not-Invented-here" - Syndrome

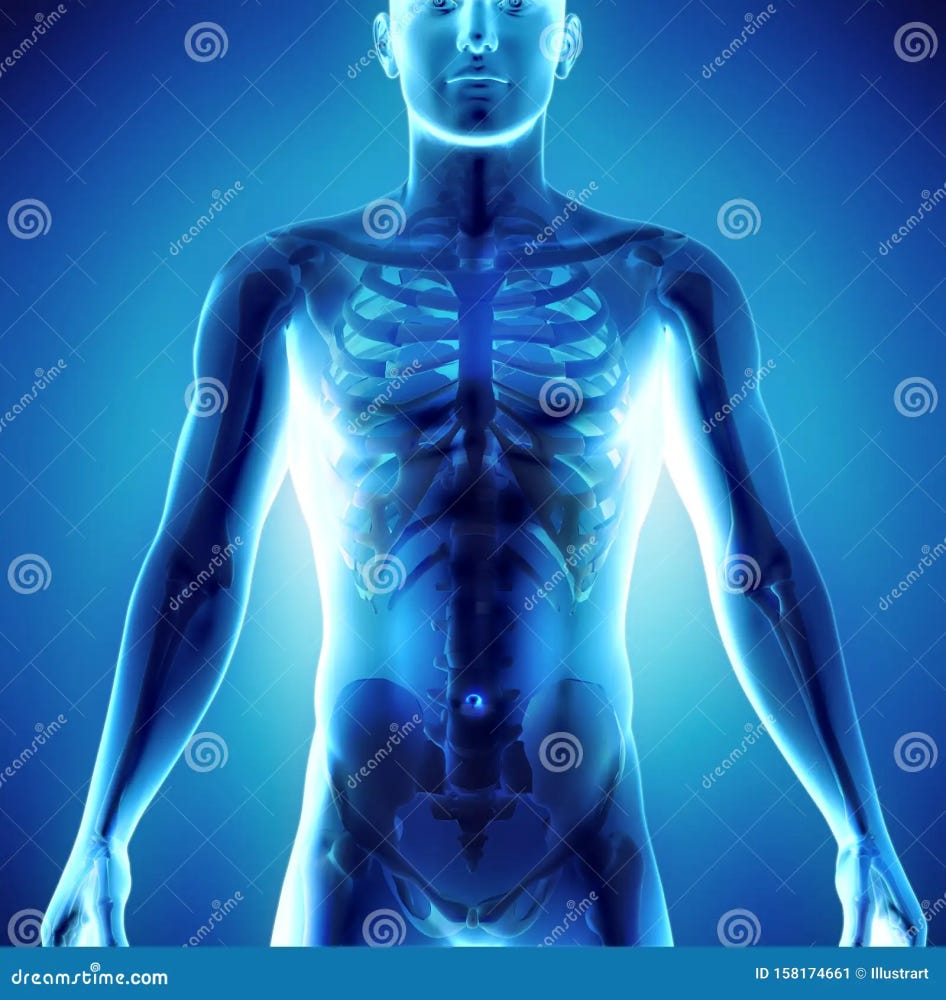

To illustrate this challenge, I often draw parallels with the human body, where the brain signifies the board and C-level executives, and the organization embodies the body itself. When a decision is made to implement a Corporate Venture Capital (CVC) initiative, which can be likened to a vital organ transplant, the 'not invented here' syndrome may rear its head. The organization may resist the CVC, much like the body sometimes rejects a transplanted organ. In essence, the board and C-level leaders must consistently stress the significance of the CVC. Their message should resonate both within the organization and in the external world, emphasizing that exploration and innovation remain paramount. This is essential in keeping a focus on innovation but also in sharing with financial analysts to capture the inherent value for shareholders.

The foundation for a successful CVC structure

Now, when corporate leaders embark on the journey of establishing a Corporate Venture Capital (CVC) initiative, they encounter a myriad of critical questions and considerations. First and foremost, they must define the precise focus and objectives of the CVC program. This lays the groundwork for everything that follows.

Conclusion

Our journey today has navigated through history, explored the challenges of corporate risk-taking, and ventured into the intricacies of setting up a CVC initiative. It's clear that while innovation and exploration may have encountered administrative hurdles, there's still immense potential to reignite the spirit of discovery and reshape the future of corporate innovation.

I hope you enjoyed this week's newsletter. If you have any suggestions or contributions that you would like to share with me, please do not hesitate to reach out. I would be delighted to hear from you.

/Jeppe